What Sellers Need To Know in Today’s Housing Market

If you’re thinking about selling your house, you may have heard about the housing market slowing down in recent months. While it’s still a sellers’ market, the peak frenzy the market saw over the past two years has cooled some. If you’re asking yourself if you’ve missed your chance to sell your house and make a move, the good news is you haven’t – motivated buyers are still out there. But you do need to price your house right for today’s market. Here’s why.

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Homes priced right are selling very quickly, but homes priced too high are deterring prospective buyers.”

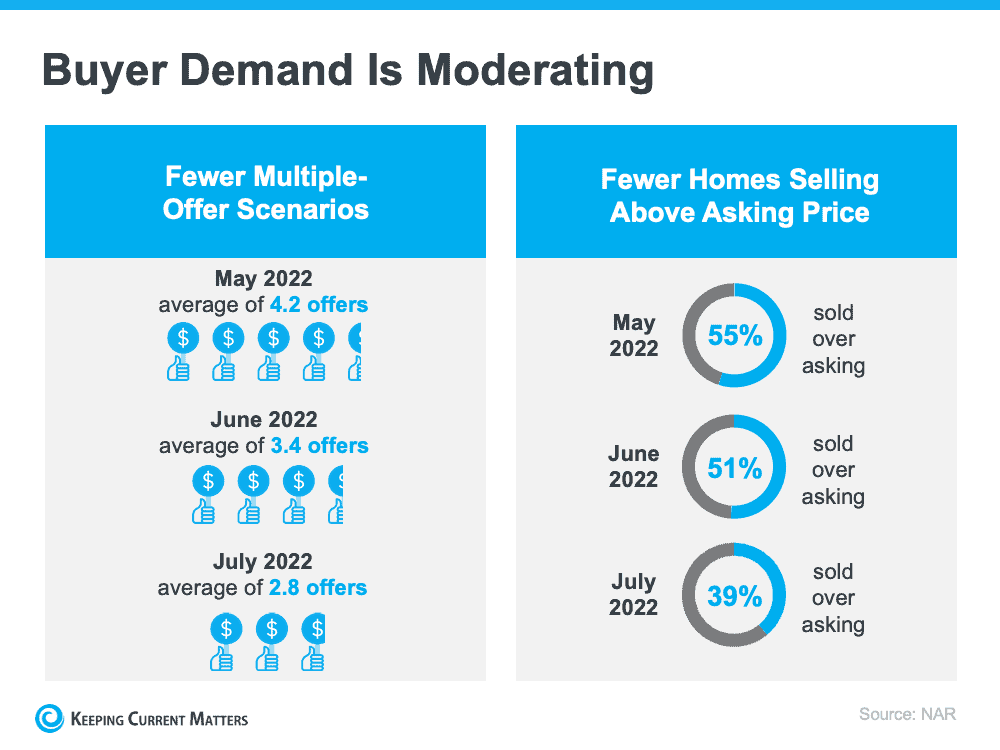

It’s true buyer demand has slowed over the past few months as higher mortgage rates made it more expensive to buy a home. The result is fewer bidding wars and less competition among buyers (see visual below):

But don’t forget – that’s compared to the severely overheated market we saw over the past two years. According to the latest Confidence Index from NAR:

“. . . 39% of homes sold above list price, down from 51% a month ago and 50% a year ago.”

While this is a slower pace than even one month ago, serious buyers are still actively in the market, and they’re buying homes that are priced right. In fact, the Confidence Index also notes the average home is selling in just 14 days.

If you’re aiming to sell your house, be sure you’re working with your agent to price it for today’s housing market. As buyer demand softens, it’s important to understand this isn’t the same market as last year. It’s not even the same market as just a few months ago. But it is still a sellers’ market.

If you’re ready to sell your house, seek the advice of a real estate professional. In some cases, you’ll need to adjust your expectations accordingly to meet the market where it is today. Selma Hepp, Interim Lead, Deputy Chief Economist at CoreLogic, explains what’s happening and what it means when you sell:

“Signs of a broader slowdown in the housing market are evident, . . . This is in line with our previous expectations and given the notable cooling of buyer demand due to higher mortgage rates. . . . Nevertheless, buyers still remain interested, which is keeping the market competitive — particularly for attractive homes that are properly priced.”

Bottom Line

While the housing market has cooled from its overheated frenzy, it’s still a sellers’ market. Work with a real estate professional to understand what’s happening with buyer demand and home prices in your local area as you get ready to enter the market.